The Uncompensated Care pool reimbursement payment is viewed as a zero-sum game, with one hospital’s reimbursement gain through the program becoming another hospital’s loss. While Worksheet S-10 has been used for UC reimbursement purposes for only a short time, audits of the S-10 data to ensure its accuracy and consistency have been a high priority for hospital providers. In its 2019 final IPPS rule, CMS stated that, due to the overwhelming feedback from commenters emphasizing the importance of audits, they would begin the inaugural audits in fall 2018.

Kyle Pennington

Recent Posts

Topics: uncompensated care, S-10, worksheet s-10, Medicare Cost Report

FY19 IPPS Final Rule: Cost Report Worksheet S-10 Is Here To Stay

Posted by Kyle Pennington on Oct 12, 2018 1:32:37 PM

The Fall 2018 issue of HFMA New Jersey's Garden State FOCUS magazine included an article titled, "FY 2019 IPPS Final Rule Update: Worksheet S-10 Is Here To Stay" which takes a look at:

Topics: Medicare DSH Reimbursement, S-10, regulations, final rule, worksheet s-10

It was an eventful 2017 for CMS when it came to Worksheet S-10 and while we blogged on each milestone individually, we thought a resource summarizing EVERYTHING that took place last year regarding S-10 would be helpful for reference. So let's waste no time and review the S-10 2017 "appearances" starting with how Medicare cost report Worksheet S-10 rose to fame.

April 28, 2017 - CMS posts the FFY 2018 IPPS Proposed Rule

-

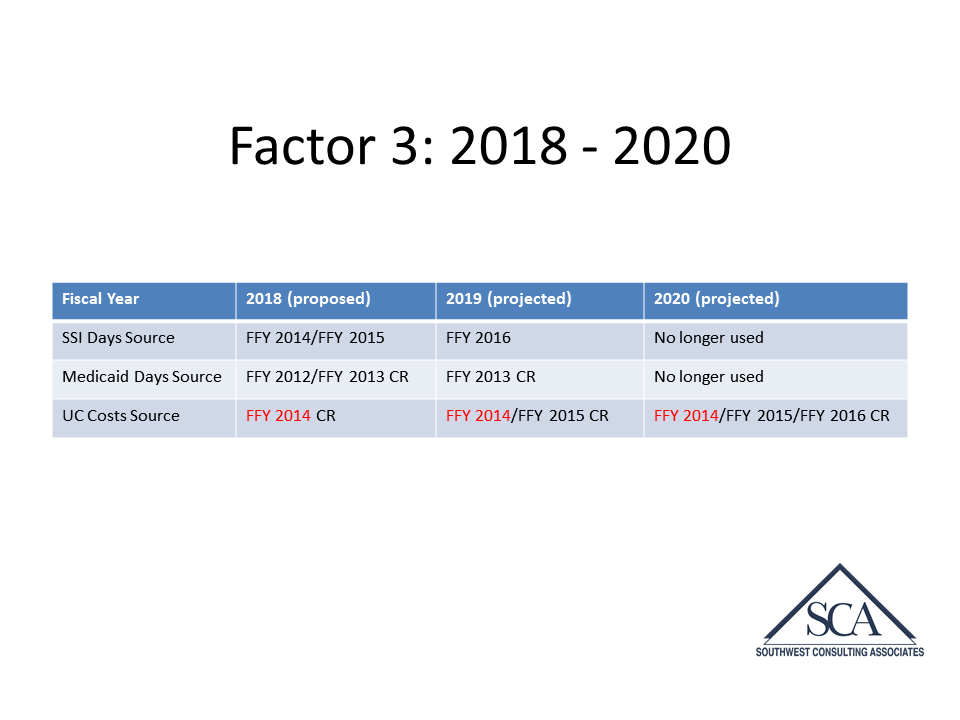

For FFY 2018, CMS again proposed to begin utilizing uncompensated care data from Worksheet S-10 to calculate qualifying providers’ Factor 3.

Topics: S-10

The Centers for Medicare and Medicaid Services (CMS) has posted a Questions and Answers document providing clarification related to Medicare Cost Report Worksheet S-10. If you’ll recall, CMS issued Transmittal 11 in September 2017 that made a number of revisions to the instructions for reporting data on cost report Worksheet S-10.

Topics: Medicare DSH Reimbursement, uncompensated care, worksheet s-10

CMS Issues Transmittal 1981, Change Request 10378 for Worksheet S-10

Posted by Kyle Pennington on Dec 5, 2017 1:48:29 PM

On Friday, December 1, 2017, CMS released Transmittal 1981, which clarifies the deadlines for uploading revised or initial submissions of FY 2014 and FY 2015 cost report Worksheet S-10. For revisions to be considered, CMS extended the deadline to Tuesday, January 2, 2018, for all IPPS hospitals to submit the data to their Medicare Administrative Contractor (MAC). On December 4, 2017, the provider education article, MM10378, was released related to this instruction.

Topics: worksheet s-10, CMS transmittal

CMS Posts FY2014 Worksheet S-10 Revisions Announcement

Posted by Kyle Pennington on Jul 13, 2017 5:44:09 PM

On Thursday, July 13, 2017, CMS announced that “amended FY 2014 cost reports due to revised or initial submissions of Worksheet S-10 received by Medicare Administrative Contractors on or before September 30, 2017, will be uploaded to the Healthcare Cost Report Information System by December 2017”. In its announcement, CMS stated that “hospitals have requested CMS provide them with an additional opportunity to revise the Worksheet S-10 submitted with their FY 2014 cost reports (starting on or after October 1, 2013, and prior to October 1, 2014)”.

Topics: DSH Reimbursement, Medicare DSH Reimbursement, Industry Updates, S-10, worksheet s-10, factor 3, CMS transmittal

CMS Issues Transmittal 1863 - FY2015 Worksheet S-10

Posted by Kyle Pennington on Jul 6, 2017 3:58:23 PM

On Friday, June 30, 2017, CMS released Transmittal 1863 (beginning on page 2), which included, among other items, guidance for MACs to follow for accepting cost reports containing revised Worksheet S-10 information. Similar to last year's Transmittal 1681, in order for MACs to accept amended cost reports due to revisions to Worksheet S-10 for FY 2015, CMS has put providers on notice by stating that “hospitals must submit their amended cost report containing the revised Worksheet S-10…no later than September 30, 2017.” CMS added, “Submissions received on or after October 1, 2017 will not be accepted.”

Topics: DSH Reimbursement, Medicare DSH Reimbursement, Industry Updates, S-10, worksheet s-10, factor 3, CMS transmittal

The 2018 IPPS Proposed Rule was put on display for public inspection on April 14, 2017 and is scheduled to be published in the Federal Register on Friday, April 28, 2017. The pre-publication version can be viewed HERE. All public comments to the proposed rule are to be received by 5 p.m. EST on Tuesday, June 13, 2017. SCA will be reviewing and analyzing the details of the proposed rule and its components, and we will provide our conclusions soon.

Topics: DSH Reimbursement, Medicare DSH Reimbursement, Industry Updates, S-10, proposed rule

In anticipation that CMS might finalize the DSH/UC payment methodology proposed in the 2017 IPPS proposed rule, CMS released Change Request 9648, Transmittal 1681 (please see page 3, paragraph 2) in July, which included, among other items, guidance for MACs to follow for accepting cost reports containing revised Worksheet S-10 information. Specifically, in order for MACs to accept amended cost reports due to revisions to Worksheet S-10 for FY 2014, CMS put providers on notice by stating that “hospitals must submit their amended cost report containing the revised Worksheet S-10…no later than September 30, 2016.” CMS added, “Submissions received on or after October 1, 2016 will not be accepted.”

Topics: DSH Reimbursement, Medicare DSH Reimbursement, uncompensated care, S-10

4 Misconceptions Regarding Medicare DSH SSI Recalculations

Posted by Kyle Pennington on Apr 14, 2016 10:00:00 AM

As discussed in a previous blog, a hospital’s Supplemental Security Income (SSI) percentage is a primary component of Medicare Disproportionate Share reimbursement and plays a significant role in determining the reimbursement impact. Also referred to as the “Medicare” fraction of the Medicare DSH calculation, the SSI ratio represents the percent of patient days for beneficiaries who are eligible for both Medicare Part A and SSI. By default, SSI ratios are based on the Federal Fiscal year end (10/01 – 09/30) and are generally published annually by the Centers for Medicare and Medicaid Services (CMS). Current CMS regulations allow for a hospital to request to have its Medicare fraction or SSI ratio recalculated based on the hospital’s cost reporting period where different from the Federal fiscal year, however, a hospital may be hesitant to request due to common misconceptions surrounding SSI recalculations. Here are four we commonly hear:

Topics: SSI Recalculations